TO: Shareholders and Partners, Novus Cannabis MedPlan

FROM: Frank Labrozzi, CEO

DATE: January 2026

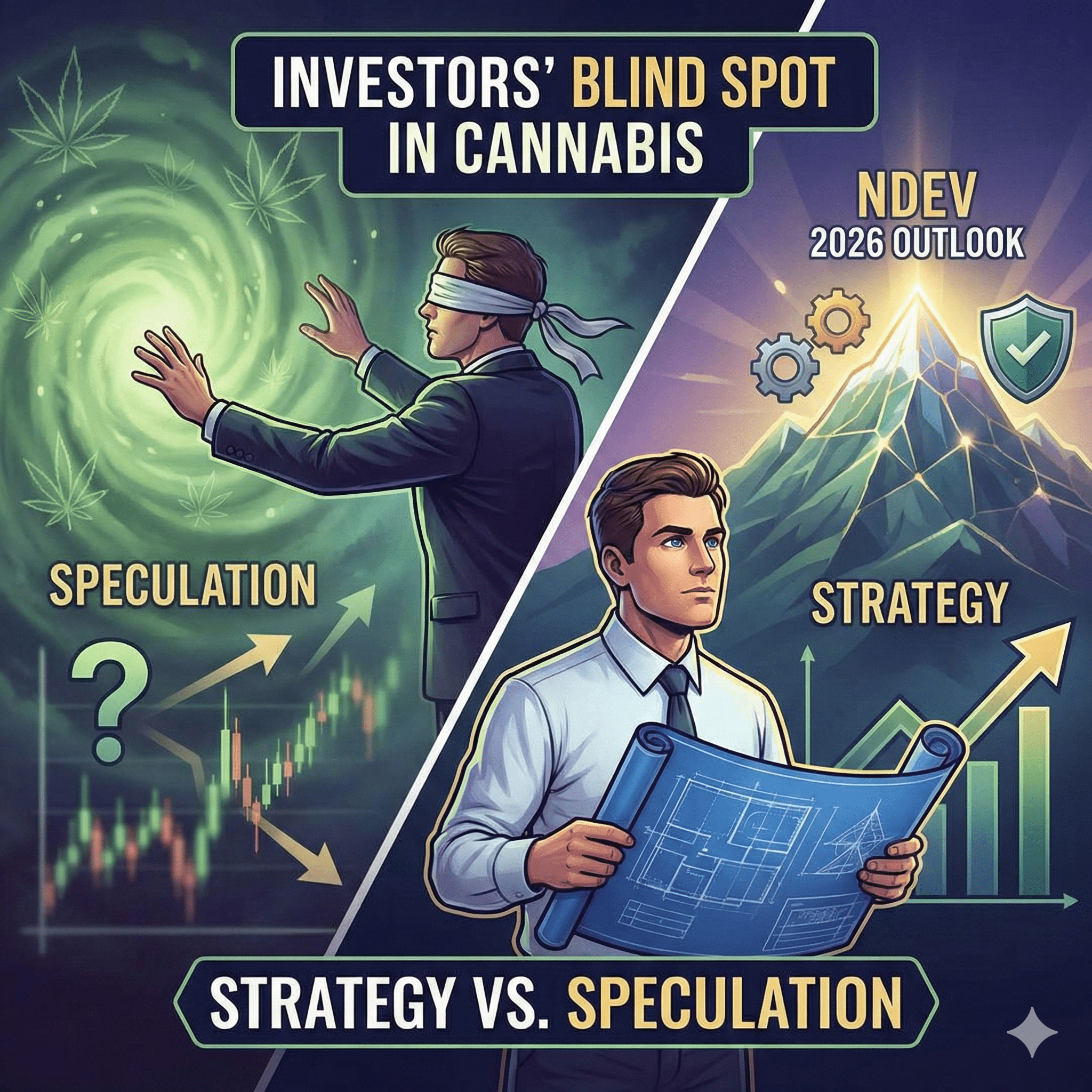

SUBJECT: 2026 OUTLOOK: STRATEGY OVER SPECULATION

Dear Shareholders,

Looking ahead, we must acknowledge the broader market dynamics. The cannabis industry is seeing a significant wave of consolidation, fueled largely by the disappointing postponement of the DEA’s rescheduling decision in January 2025.

However, many investors have a significant blind spot: they are waiting for “Federal Approval” before they invest. This perspective is fundamentally wrong. It ignores how deeply the cannabis sector is already integrated into the healthcare ecosystem.

Novus’s business model is positioned to thrive regardless of the rescheduling timeline. Our strategy has not yet been reflected in the market price, representing a unique value opportunity.

Financial Discipline & Growth

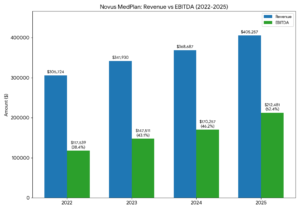

While the industry contracts, Novus has expanded. We closed the 2025 fiscal year with 18.1% gross revenue growth. More importantly, our operational efficiency has delivered EBITDA margins of 48%.

This financial performance validates our core thesis: Our success is not dependent on fluctuations in the price-per-pound of cannabis. We are building value on the structural side of the industry, where margins are protected.

The chart below perfectly supports our narrative that Novus becomes more profitable as it scales, unlike traditional cultivators, who often see margin compression.

Note: Q4 2025 is projected

The True Moat: Understanding Schedule III

The market is mispricing Schedule III. It is a federal acknowledgment of medical utility, not a recreational free-for-all.

The core reality is that Schedule III explicitly moves cannabis into the realm of prescriptions, insurance reimbursement, and healthcare regulation. While recreational users will inevitably require health plans to cover associated costs, the law’s primary focus is on medical application. This creates a distinct divergence:

• Recreational Brands: Companies selling cookies and gummies will face strict, immediate FDA scrutiny under a Schedule III regime.

• Novus MedPlan: We are purpose-built for this exact regulatory environment. We are HIPAA-compliant, insurance-based, and prescription-ready.

This is “The Medical Moat.” Our strong position allows us to control access to the cannabis reimbursement market, establishing a substantial barrier to entry that purely recreational businesses must contend with.

Business Model Innovation: Solving the Tax Puzzle Now

While the industry waits for Schedule III to fix 280E tax burdens, we have already structurally solved it for policyholders and eased it for cannabis verticals. We engage in Regulatory Arbitrage to integrate tax deductions right now. Here is how the mechanics work:

1. For Policyholders (The Tax Advantage) We have restructured the transaction to maximize financial benefits. Revenue stems from “Bundled Benefit” insurance premiums, not direct cannabis sales.

• The Mechanism: We classify premium collection as traditional prescription drug plan payments. Cannabis is positioned as an ancillary, value-added benefit.

• The Result: Premium expenses become fully tax-deductible for the payer, falling under accepted prescription drug coverage. We transform a non-deductible, cash-based expense into a fully auditable, insurable, and tax-advantaged benefit.

2. For Cannabis Verticals (The Distribution Advantage) Novus (NDEV) has established a superior distribution method yielding significantly higher margins than traditional dispensaries.

• The Mechanism: The nominal “discount” given to eligible policyholders at the point of sale is fully recouped via our insurance reimbursement mechanism.

• The Result: This payment is guaranteed to Novus, independent of the policyholder’s retail purchase. This distinct, high-margin model drives robust growth even as economic pressures challenge standard cannabis business models.

An Uncorrelated Hedge

Most of the “cannabis basket” in your portfolio is highly correlated to commodity pricing. If wholesale flower prices drop due to weather, pests, or oversupply, MSO margins crash.

Novus is not a cultivator; we are an Insurance Carrier and Technology Wrapper.

Our revenue stream is driven by stable, recurring monthly premiums. This is fundamentally insulated from agricultural risks. Owning Novus protects your cannabis portfolio by providing a de-risked asset that moves differently from the rest of the market.

The Opportunity Ahead

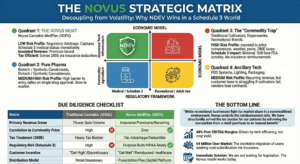

Consider the immense market potential: 64 million medical and recreational cannabis users could be interested in a prescription drug plan that incorporates cannabis coverage. We have structurally solved the tax burden for our patients by reframing the transaction. This is a game-changer that creates value today. Please review below the Novus Matrix and Quadrant Chart for a one-page explanation of our due diligence and competitive landscape. We are confident in our direction and thank you for your continued partnership.

About Novus Cannabis MedPlan:

Novus Cannabis MedPlan is a premier provider of medical cannabis supplemental health plans, dedicated to enhancing the accessibility and affordability of medical cannabis for patients nationwide. Through a robust network of licensed dispensaries, qualified physicians, and wellness providers, Novus delivers comprehensive membership benefits structured to support patient health journeys with transparency, dedicated care, and notable financial benefits.

Further Research:

- Financial Filings: Click Here

- Quote: Click Here

- Investor’s Page: Click Here

Forward-Looking Statements

This release includes forward-looking statements, which are based on certain assumptions and reflect management’s current expectations. These forward-looking statements are subject of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Some of these factors include general global economic conditions; general industry and market conditions and growth rates; uncertainty as to whether our strategies and business plans will yield the expected benefits; increasing competition; availability and cost of capital; the ability to identify and develop and achieve commercial success; the level of expenditures necessary to maintain and improve the quality of services; changes in the economy; changes in laws and regulations, includes codes and standards, intellectual property rights, and tax matters; or other matters not anticipated; our ability to secure and maintain strategic relationships and distribution agreements. Dilution, if any, would be for the purposes of management taking stock in lieu of cash salary. Novus disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Additionally, this press release that is a not statements of historical fact may be considered to be forward-looking statements. Written words such as “may,” “will,” “expect,” “believe,” “anticipate,” “estimate,” “intends,” “goal,” “objective,” “seek,” “attempt,” or variations of these or similar words, identify forward-looking statements. By their nature, forward-looking statements and forecasts involve risks and uncertainties because they relate to events and depend on circumstances that will occur in the near future.

Investor Contact Information

855-228-7355

Email: info@getnovusnow.com