Investor Relations

Only health insurer to incorporate cannabis into standard benefits is scaling without the need for equity dilution.

Investment Thesis

Business EcoSystem

Proprietary, compliant health plans integrate cannabis and prescription drug coverage with reimbursement structures, creating a financial moat that drives stable, recurring revenue and benefits Novus and its in-network providers.

Asset Driven

Focused on premium receivables, our business model avoids 280E restrictions by excluding the handling of cannabis plants or their profits. This actuarial data-driven strategy generates premiums, historically yielding an EBITDA margin of 48%-50%.

Valuation Method

The company's valuation uses Embedded Value (EV), an accepted insurance metric based on Net Asset Value (NAV) from annualized contracts. EV is preferred over simple book value as it more accurately reflects the company's true worth by including expected future profits from the current business.

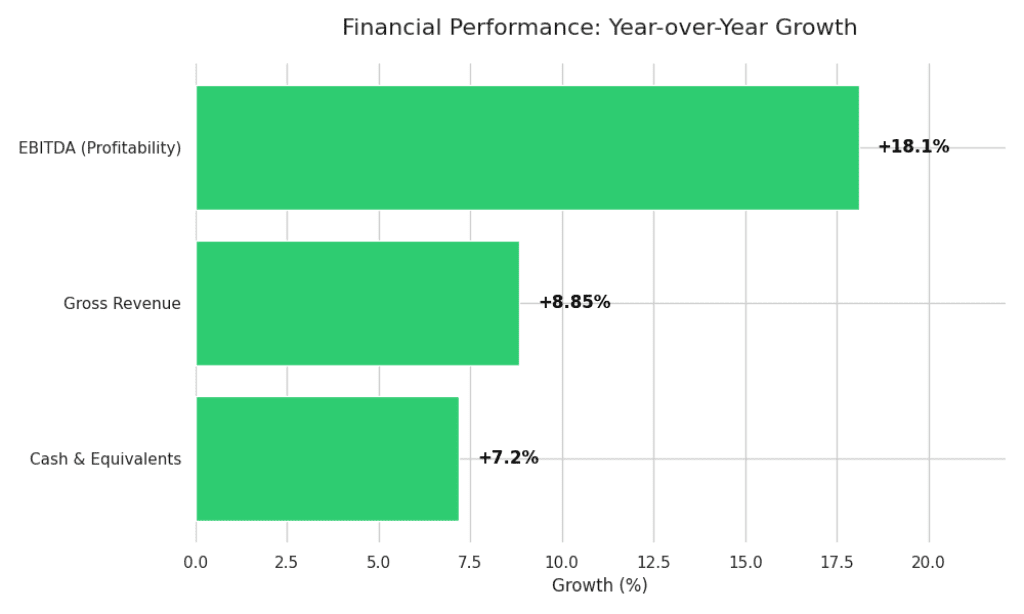

Financial Highlights

Capital Structure

As of September 30, 2025

Clean Balance Sheet With No Toxic Debt Features

| Authorized Shares: | 200 million | |

| Outstanding Shares: | 126,803,624 | |

| Float: | 30,948,730 | |

| Par Value: | $0.001 | |

| Restricted Shares: | 86,989,251 | |

Novus Acquisition & Development Corporation (NDEV), operating as Novus Cannabis MedPlan®, has pioneered health insurance that covers both THC/CBD cannabis and traditional prescription drugs since 2015. This proprietary dual-coverage structure provides a financial moat, ensuring stable, recurring revenue for Novus and its in-network providers.

Revenue is generated from insurance premiums, giving policyholders access to medications via an online distribution platform. NDEV has a national reach through 3,000 agents/brokers and over 200 dispensaries.

Cap Structure

As of September 30, 2025

| Authorized Shares: | 200 million | |

| Outstanding Shares: | 126,803,624 | |

| Float: | 30,948,730 | |

| Par Value: | $0.001 | |

| Restricted Shares: | 86,989,251 | |

Due Diligence Links

As of September 30, 2025

| Quote: | Click Here |

| Filings: | Click Here |

| Pitch Deck: | Click Here |

| Investment Highlights Video: | Click Here |

Footnotes:

- Leak Out Vendor Shares: Third-party vendors with treasury-issued stock must sell their shares gradually based on 15% of the average daily trading volume over the past 30 days.

- Insider Sales: No insider selling common stock for three years.

1. Compliance & The “Ancillary” Advantage

Novus is a non-plant-touching technology and administrative platform. Because we do not handle or profit directly from the sale of cannabis, we are not subject to IRS 280E tax restrictions. Our core product is a federally compliant Prescription Drug Program (PDP); cannabis is integrated strictly as a “value-added” discount feature, de-risking the model for institutional investors and traditional banking.

2. Employer-Centric Customization

We empower HR departments to modernize health benefits without legal exposure. Novus provides the framework for companies to align corporate values with modern wellness needs, offering a compliant structure that integrates cannabis-inclusive policies into traditional employer-sponsored health plans.

3. Novus Cannabis RX: Hybrid D2C Platform

Our Direct-to-Consumer platform bridges traditional healthcare and the cannabis industry through a “hybrid” model:

Traditional PDP: A robust prescription drug plan for FDA-approved medications.

Value-Added Access: Exclusive, pre-negotiated discounts at a nationwide network of licensed dispensaries.

Digital Integration: A single, professional portal for both traditional pharmacy benefits and alternative wellness.

4. Strategic Market Expansion

Novus is the primary “on-ramp” for consumers transitioning from the legacy (unregulated) market to legal, lab-tested products. By targeting the untapped employer market and partnering with national insurance brokers, the Novus MedPlan is positioned as the definitive distribution solution for the mainstreaming cannabis economy.

Federal Regulation: A Model Optimized for Growth

Strategic Positioning & Tax Efficiency Novus is engineered to thrive within the current regulatory landscape. As a non-plant-touching technology and administrative platform, we are structurally insulated from the punitive IRS 280E tax restrictions that impact cultivators and retailers. This allows Novus to maintain standard corporate tax deductions and a healthy, scalable bottom line.

Institutional-Grade Compliance We operate as a “grown-up” player in the space, prioritizing rigorous adherence to federal financial standards. Novus maintains strict Anti-Money Laundering (AML) and Bank Secrecy Act (BSA) protocols. This commitment to high-level compliance ensures we remain “institutional-ready,” safeguarding our relationships with traditional banking partners and enterprise-level clients.

Legislative Catalysts as Growth Drivers Rather than remaining unaffected by federal shifts, Novus is positioned to catch the wave of industry evolution. We view Cannabis Rescheduling (Schedule III) and the SAFER Banking Act as massive growth tailwinds. These milestones will lower the barrier for entry for Fortune 500 employers, triggering a surge in demand for the compliant, turnkey benefit solutions that only Novus provides.

Interstate Scalability By utilizing a state-regulated insurance framework and a federally compliant Prescription Drug Program (PDP), Novus can scale efficiently across legal jurisdictions. We provide a federally defensible bridge between traditional healthcare and the cannabis industry, offering stability in an evolving market.

Contact Us

* Indicates Required Field

855-228-7355

We are available Monday - Friday 9:00 am - 5:00 pm (EST) Email: info@getnovusnow.com